Could it be possible to generate the equivalent of 50% or even 75% royalties on the gross production of a well that includes your mineral acreage? I don't know but if the operators can generate 50% AFTER all development/completion/production costs and AFTER paying a 25% royalty to owners, it may be possible that, with appropriate support, a group of united owners might be able to increase their effective royalty from 25% while still getting the help they need to manage the drilling and production process.

I'd like to find out BEFORE I sign a lease that makes co-production impossible. Let me know what you think. Is it worth exploring? Leave a comment here.

IT'S YOUR GAS ... ENJOY IT!

Saturday, February 23, 2008

Owners Explore for 75% Royalties

Gas Prices To Rise?

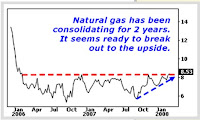

In a 2/13/2008 article at "Money and Markets" entitled "Natural Gas Looks Undervalued; Ways to Play It," Sean Brodrick believes that natural gas prices are unusually low compared to oil. If oil stays up, natural gas should also rise to maintain the historic ratio of oil to gas energy costs.

In a 2/13/2008 article at "Money and Markets" entitled "Natural Gas Looks Undervalued; Ways to Play It," Sean Brodrick believes that natural gas prices are unusually low compared to oil. If oil stays up, natural gas should also rise to maintain the historic ratio of oil to gas energy costs.

If so, this will make the future of the Barnett Shale even brighter and make cooperative or commercial development even more profitable. Could gas go up 50% or more? I hope so ... at least till I get my electric or gas bill.

IT'S YOUR GAS ... ENJOY IT!

What's it worth?

If you are like me and own a home in Tarrant County, you may have been surprised to get a big envelope in the mail offering to lease your minerals. Wow, someone wants to give me money! Maybe even thousands of dollars. And I don't have to do anything but open the mail and sign the draft lease that is enclosed. Mailbox money ... how wonderful!

Then the old warnings my momma told me, like "sounds too good to be true" or "beware of strangers bearing gifts," start coming to mind. What is this lease anyway? It takes 4 legal sized sheets of single spaced print that is almost too small to read to document the terms that accompany the offer. Why so complex?? If they want to give me money, just send it.

"Maybe there is more to consider," one thinks. So you start listening to the news, reading articles in the newspaper and searching the web for information on what a mineral lease is all about.

Then the questions really begin to multiply. Who really owns these minerals? One finds out that they may need a legal expert to advise them on "Pugh clauses," "post-production deductions" and "surface rights." What is a fair offer ... some are getting over $20,000 per acre ... others only $2,000 per acre? Terms vary from 3 years to 5 years. Some get credit for streets and alleys ... some do not. Some get 25% royalty ... others 3/16ths or less. And 25% of what and when will that start and/or end? What happens if I need to sell my home ... will new legal or closing costs pop up that wipe out all my profits? Will my property taxes rise? Do I have to put up with huge, dangerous, noisy, stinky, ugly stuff in my neighborhood that tears up roads and invites "rough necks" to look over my fence?

What are they really asking me to do? Will they tear up my streets? Will they permanently install big ugly equipment? When will the money arrive? How much now? How much later? Why are they going to all this trouble? Is it good for me, my family, my neighbors?

One feels a little overwhelmed and doesn't understand the implications but "what the heck" its quick "free" money. The letter is written nicely on fine bond paper with a great looking letterhead ... but its too complex to figure out. I don't have a better offer so maybe one should just sign, take the money and forget it. What will be, will be.

The meetings with operator representatives lead one to believe signing is urgent and you may loose this opportunity if you don't sign now. No one will ever offer more, they claim. It's so risky and complex to drill. They have all the tools and knowledge to get the permits, equipment and pay the royalties. "I'm lucky to get this deal ... just sign here," they urge.

But I guess they didn't count on me having the time to really look into the subject or knowing how to use the Internet to make my findings known. It's a new day and age and I'm a retired R&D engineer from Lockheed Martin. I actually may know how to explore and address some of the issues.

That is why I am writing this blog. I studied and I found some things that I hope others will be glad to know without doing all the work that I did. Things that can be quite difficult to find.

I hope you enjoy some of the highlights that follow but be forewarned, these are preliminary findings that I believe are true but are subject to change with additional discovery. Also note that while I believe these things to be true ... you should confirm them independently and do your own due diligence before signing any lease or committing to any investments.

FIRST: What are my minerals worth?

According to a Fort Worth Star-Telegram article in early December, just over half of the Barnett Shale gas reserve is recoverable if horizontal wells are drilled on a 20 acre spacing and successful hydraulic fracturing of the shale is done. If one assumes that the average price of gas over the next 20 years will be at least $10 per 1000 cubic feet, about $1,000,000 per acre is recoverable.

That explains it! No wonder the operators are clamoring to lease Tarrant County. $1,000,000 per acre! $250,000 per 1/4th acre lot! If it doesn't cost too much to drill, no wonder they are willing to pay thousands per acre to get the right to drill.

SECOND: What does it cost to drill?

Again this information is a little tough to find but there are a number of sources of estimates. The Department of Energy and web sites of the major drillers and tool companies offer some guidance.

For example, Baker Hughes has drill bits that they claim can drill over 100 feet per hour so the time required to drill to a depth of 8000 feet then add a 4000 foot lateral (horizontal) bore (12,000 ft total) should be about 120 hours (4 to 5 days). At 10% per year interest rates plus 100% overhead, the $30 million of equipment at a typical drill site should cost under $1000 per hour to lease. Consumables and labor should add less than another $1000 per hour. Thus initial actual drilling may be as low as $250,000. Even doubling that estimate comes to only about half a million for a typical well.

To this drilling cost, the cost of site planning, engineering, permitting and preparation must be added prior to drilling. Seismic data collection, instrumentation, laboratory analysis of samples and other related costs are significant and must be added to the drilling. Then after drilling, the cost of casing and cementing, fracturing and completing must be added along with site cleanup, pipeline connection and finalization. Of course to that one must add appropriate overhead, insurance and profit but it is hard to see how well costs could exceed $2,000,000 for a well that some estimate could produce $20,000,000 worth of gas.

It is not clear what they included to increase this estimate, but I have seen estimates from XTO, Chesapeake and others of as high as $5M per well. In any case, weather it is $2M or $5M, the drilling of a well in the Barnett shale is, on average, very profitable for an operator. From the operator's view, a well produces $20 to 30M but costs him at most $5M to drill and maintain plus about $4 or $5M in royalties to the property owners. That leaves a tidy amount, $10,000,000 per well net to the operator from which to pay more landman fees, signing bonuses, tax accountants, lobbyists, campaign contributions, country club dues, shareholder dividends, etc., etc.

On the other hand, from the mineral owners point of view, a typical 1/4th acre suburban lot may be able to produce about $250,000 in gas. From that production the owner will get a signing bonus of from $500 to $5000 up front plus (if fully developed to 20 acre well spacing) royalties totalling up to $50,000 over the 20 to 30 year life of a well unit. Production (and thus royalties) are higher at first (perhaps up to $10,000 per year) and taper off over the years to well below $1000 per year as the gas is sold.

When signing the lease, the owner is thus giving the operator (and any subsequent companies that may buy your lease from the original lessee) the exclusive control and right to develop and extract all minerals at all depths under the property. For that the owner gets an on-going share of the resulting production value (if any) and a one-time signing bonus.

Now you know ... in addition to the house and property you bought, YOU also probably own about $250,000 worth of gas in the subsurface mineral estate. That's a nice bonus but it comes with additioinal responsibility. It is your responsibility to manage your newfound mineral estate for the best interests of you and your family.

IT'S YOUR GAS ... ENJOY IT!