Some claim they can tell the future but nobody really knows unless they are working with a very predictable process.

Some claim they can tell the future but nobody really knows unless they are working with a very predictable process.

For example, the engineers I worked with at Lockheed knew exactly what the THAAD missile (in the picture here) was going to do. The "cork screw" maneuver was required to adjust energy during the flight. It was planned and the missile continued on it's trajectory to a perfect intercept of the target.

Note that if it didn't do exactly what was planned and predicted, the Range Safety Officer would have destroyed the bird shortly after launch. So even very complex situations, with the right information and analysis, can be predicted accurately.

When it comes to the Barnett Shale, many observers can see the momentum building and know that change is on the way but accurate predictions are difficult. Never the less, let's take a look at what has happened in recent years in the Barnett shale field and see if you agree with me about some aspects of the future. If I'm right, it could put tens or perhaps even hundreds of thousands of ADDITIONAL dollars in your pocket.

Until a few years ago, few had even heard of the Barnett Shale. As early as last spring, properties in Tarrant County were sold with little consideration of mineral rights. I know because, unfortunately, I sold one and never thought of withholding a share of the minerals. And it was never mentioned by my agent.

Three years ago, a few leases were being made in Tarrant County but mostly in the northwest quadrant. D/FW Airport was just being leased by Chesapeake. Now, drilling permits issued in the 18 county Newark (Barnett Shale) Field in 2005 through 2007 rose from about 1100 to over 3600. Gas production rose from 501 to 768 BCF over the same period. (Ref a)

Now, drilling permits issued in the 18 county Newark (Barnett Shale) Field in 2005 through 2007 rose from about 1100 to over 3600. Gas production rose from 501 to 768 BCF over the same period. (Ref a)

Leasing bonuses are hard to pin down but I believe they have increased from under $500 per acre to over $15,000 per acre during the same 3 years. If you have specific examples during 2005 and 2006, please let me know. But the best I can tell, only a few insiders knew what was happening three years ago. Little was mentioned in the news paper and blogs were not common.

Now it is different. The Barnett Shale headlines and several articles appear in the Star Telegram each week. Leasing agents and land men are busy. Property owner groups and blogs about the Barnett Shale field are plentiful and expanding.

And all this activity is clearly appropriate. It starts with a natural gas resource with the potential of over $1 million per acre almost anywhere you drill in Tarrant county. No wonder the bonuses are now over $25,000 per acre. That is less than 3% of the potential production.

And if bonuses have risen from under $2500 per acre to over $25,000 per acre in one year, what will they be by the end of the year? Again no one really knows where bonuses and royalties will evolve but my guess, based on the momentum I see, is that they are not going down. Drilling and production technology is well understood in the industry.

For example, a developer like XTO or CHK or DVN can drill wells for about $3 million each (possibly less) and produce over $15 million of clear profit per well AFTER all drilling and royalty expenses are paid. Why wouldn't they pay a little more for leases, particularly if other operators take note of the potential profit and decide to compete?

I'm not saying the risk in the oil and gas business is nil or that the work is as easy as changing a light bulb or watching grass grow. But I am saying it is not rocket science either. Workers are skilled but I doubt they are more skilled or hard working than many farmers, construction workers, railroad workers or manufacturing workers.

While some scientists and engineers are required, do exploration and development companies have tens of thousands of degreed engineers like Lockheed Martin or Boeing? Are work tolerances measured in a few nanometers like they are at TI or Intel?

Also note that the cost of capital equipment is high in the drilling business but it pales in comparison to that in many industries. For example, a new National Oil Well Varco Flex Rig is under $15 million while American Airlines routinely pays over $150 million for new airplanes. Airports frequently cost several billion to build. Intel manufacturing plants are in the billions but are only good for a few years until their technology becomes obsolete. Even the vaunted new Cowboy Stadium was about $1 billion and it sits empty and unused most of the time.

And the risk of drilling a bad well in Tarrant county is not zero but it appears to be much less than 10%. So is it so unreasonable that bonuses could increase? Could they ultimately rise to over $50k per acre (about $1 million per 20-acre well)? Could royalties rise from the current 25% level to 30% or even 50% ($6 to $10 million per well) and still result in healthy profits for developers like XTO?

I'm sure neither Devon nor XTO would ever admit it but within a year or so, some Tarrant county property owners may be offered the illusive 50/50 deal. What do I mean by that? I mean that, based on the building momentum of activity, it would be fare to all concerned if signing bonuses on a 3-year lease exceed $50k per acre and royalties reach 50% of gross production.

In fact as far as I am concerned, anything less is a gift to the economy that has handed us gasoline rapidly approaching $4 per gallon and average electricity bills approaching $300 per month. And Chesapeake has proven they can figure out how to spend the money from our gas.

Please lease your land for what ever deal you think is fare. If you want to "donate" most of your gas to the developers, I'm sure Aubrey and Bob will really appreciate the growth in their already amazing net worth. (Click the names to see what I mean.)

But if you want a more significant share of the benefits from YOUR gas, it will take some effort. It won't just happen. You will have to get organized, develop a plan, stand up and demand

50/50 or Bust !!

IT'S YOUR GAS ... ENJOY IT!

_________________________________

Ref a: Newark East Statistics 2008

Wednesday, April 2, 2008

So Where Is This Going?

Wednesday, March 26, 2008

Peaking At Chesapeake

According to Chesapeake's CEO, Aubrey K. McClendon, during his 3/25/08 conference call, the Barnett Shale has the highest rate of return on capital investment of any of Chesapeake's three major drilling areas. To make sure that they hold their leases, which are becoming much more expensive to acquire due to increased competition, Chesapeake is increasing their rig count in the Fort Worth area from 40 to 45 rigs.

However, Chesapeake's CEO went on to announce (quite reluctantly due to the desire to maintain competitive security) a new shale discovery in Louisiana that he believes is even more important than the Barnett Shale. Mr. McClendon indicated that the Haynesville Shale in northern Louisiana is ... "the most important operational announcement in Chesapeake's 19 year history." With 200,000 acres leased and a goal of 500,000 acres in the next few years, this field could increase net-to-Chesapeake potential reserves by up to 20 TCFE ($200 Billion at $10/MCFE). This compares to 260,000 net acres in the Barnett Shale with about 8 TCFE in reserves. Further detail about the Chesapeake announcement is also available in the Fort Worth Star Telegram article by Maria Perotin entitled "Chesapeake discovers Louisiana gas field."

Details of the discovery were limited during the call since they are competitive sensitive. However, drilling and development net costs for the new area should be similar to the $2/MCFE that is typical of the Barnett and other prime areas being developed by Chesapeake.

In a related article the magnitude of these estimates from Chesapeake were corroborated by Cubic Energy, a competitor in the Haynesville area. In this article Cubic claims their reservoir engineering estimates indicate gas reserves for the Bossier/Haynesville shale ranges from 217 to 245 BCF/section. That is about 40% greater than the reserve estimated by XTO (160 BCF/section) for the Barnett shale of Tarrant County.

So what does this mean for the mineral owners in the Barnett Shale? Could this mean that Chesapeake will be distracted by a new opportunity? Will already strained drilling programs and dollars be diverted to other opportunities? Will this further delay the required intensive development of Fort Worth minerals (except the minimum required to hold them by production)?

Such distractions could significantly limit the royalty stream paid on leases in the Barnett Shale for many years. So if you have leased a quarter acre to Chesapeake, you might well forget about receiving any royalties above $500 per year for many years to come. Chesapeake may be "too busy" if their interest in the Barnett Shale has peaked and they are "moving on" to prettier plays where they can focus on higher returns for shareholders.

IT'S YOUR GAS ... ENJOY IT!

Monday, March 17, 2008

Sunlight Insight ...

As I continue to research the natural gas situation, I came across some info of a different sort. I thought these findings might be worth sharing. Sorry if this old engineer bores you to tears.

As I continue to research the natural gas situation, I came across some info of a different sort. I thought these findings might be worth sharing. Sorry if this old engineer bores you to tears.

First, according to the DoE Energy Information Administration, the U.S. uses about 100 quads of energy each  year (includes oil, natural gas, coal, nuclear, wind, solar, hydro, etc.). A quad is a quadrillion BTUs.

year (includes oil, natural gas, coal, nuclear, wind, solar, hydro, etc.). A quad is a quadrillion BTUs.

I would not be surprised if about half of that energy is waisted with low efficiency systems that could and should be replaced or upgraded. We need newer high efficiency appliances, insulation, transformers, engines, transmission lines, etc. as much as we need more energy.

Second, the energy deposited on the lower 48 states by the sun each year is about 100,000 quads. Thus we have a free source of energy that exceeds our needs by a factor of 1000 but we just don't yet know how to use it very effectively. Third, agriculture on prime heartland is able to convert at most about 1/2 of one percent of the sunlight on a given acre into raw biomass feed stock (cellulose, sugars, starches, oils, etc.) each year. By the time the biomass is refined into more usable forms like ethanol or butanol, only about 1/10th of one percent of the original sunlight energy is captured in usable liquid hydrocarbon "fuel."

Third, agriculture on prime heartland is able to convert at most about 1/2 of one percent of the sunlight on a given acre into raw biomass feed stock (cellulose, sugars, starches, oils, etc.) each year. By the time the biomass is refined into more usable forms like ethanol or butanol, only about 1/10th of one percent of the original sunlight energy is captured in usable liquid hydrocarbon "fuel."

That implies that if the ENTIRE United States were planted in corn that is converted to ethanol or other biofuels, we would just barely be able to provide the energy required; i.e., 100 quads. Unfortunately, some land is not suitable for agriculture (rocky soil, mountains, deserts, lakes, cities, etc.) and some is needed for food production, timber production, recreation, living space and other uses.

Thus it seems that we MUST do something to increase the efficiency of solar conversion if we are to have an economy that is sustainable in the long term and if we want to mitigate any negative effects of both the carbon load of fossil fuel utilization and the waste products (or worse nuclear, thermonuclear and dirty bombs) from nuclear power generation.

I find confusing the current emphasis on government subsidies for biofuels and related research. Surely someone at the DoE is aware of these fundamental limitations and has made Congress  aware of them too. However, I hear little of this from ADM or the farm lobbies or the major networks or anyone else with significant influence.

aware of them too. However, I hear little of this from ADM or the farm lobbies or the major networks or anyone else with significant influence.

In short, biofuel is very unlikely to be able to meet the need and fossil fuels eventually run out. That leaves solar (and its direct derivatives wind and hydro) and nuclear as potentially sustainable sources (and solar IS nuclear without the radioactive waste).

Am I missing something or should Congress (and they are OUR designated decision makers) focus its attention (research, regulation, tax policy, etc.) on the development of 1) improved efficiency energy loads and 2) improved efficiency solar sources as the primary energy policy objectives for the next decade?

Saturday, March 15, 2008

What's The Deal?

OK folks, I think I understand the situation. The big oil and gas operators have figured out that there is a lot of money to be made  in Tarrant County if they can get minerals leased before the competition beats them to the punch and before property owners figure out how to organize and demand a more significant share of the proceeds.

in Tarrant County if they can get minerals leased before the competition beats them to the punch and before property owners figure out how to organize and demand a more significant share of the proceeds.

They have drilled a few wells and found that the Barnett Shale gas reserve is real ... VERY REAL. They also found that property owners don't know what's going on and don't have time to figure it out and get organized. They found the average drilling unit can produce $20 to $30 million in gas per well drilled. They know how to complete wells for under $5 million per well (perhaps as little as $2 million). They have demonstrated a 90% or so success rate. Thus they expect to book about 50% of the proceeds from a well after all royalties and expenses. They found that government officials at the city, county and state level are not yet aware of any significant new environmental, property value or explosion hazard risks to their constituents from urban drilling. They have the know how, regulatory environment, political clout and legal position to control the gas production once the leases are signed and drilling is begun. Their initial well investment is quite small and the production of early wells will pay for the rest of the development process. Return on their INITIAL investment to lease and drill the first wells is HUGE (easily 10,000% or more).

Folks, as I see it, we only have two choices.

- organize a little and sign the best lease deal that community volunteers can negotiate or

- organize enough to produce the minerals ourselves.

The first option will result in a 50 or 60 year process that will pay the average 1/4th acre lot owner about $50,000 or $60,000 over the life of production. Those  payments will come as an initial signing bonus of a few thousand followed by royalties averaging about $75 per month (current dollars) for 60 years. That is not a bad return for a minimum investment of time and no money invested up front. That is the option most are choosing at this time.

payments will come as an initial signing bonus of a few thousand followed by royalties averaging about $75 per month (current dollars) for 60 years. That is not a bad return for a minimum investment of time and no money invested up front. That is the option most are choosing at this time.

The second option offers the opportunity to enjoy a quicker return and a larger return but requires a little more effort up front and a modest investment not required by  option 1. If enough 1/4th-acre owners put their land and resources together, the development time could be reduced to under 5 years (compared to 30 or 40 years for option 1) and the total production share could rise to $120,000 to $180,000 (a factor of 2 to 3 more than option 1). The initial investment required to get the additional $60 to $120 thousand can likely be held to under $5,000 to seed the production process (perhaps a little as $2000).

option 1. If enough 1/4th-acre owners put their land and resources together, the development time could be reduced to under 5 years (compared to 30 or 40 years for option 1) and the total production share could rise to $120,000 to $180,000 (a factor of 2 to 3 more than option 1). The initial investment required to get the additional $60 to $120 thousand can likely be held to under $5,000 to seed the production process (perhaps a little as $2000).

Current owners can lease their mineral estates to the big operators for a "share" of the production or they can tend their own garden, plant some seed and harvest a bumper crop themselves. It depends on whether one wants to be a "share cropper" or an independent farmer.

In either case the upfront costs will be paid. Like the farmer must pay for the seed and the cost of the tractor and the cost of the fuel to operate the tractor and the cost of hired labor, such costs will be deducted from the production proceeds. The only difference is that, in one case, most of the profits are enjoyed by the stock holders of the operators, in the other, they are enjoyed by the mineral owner. It is your choice.

To leave a comment about what you want to do, click on the word "comment" below. To email this article to a friend, click on the envelope icon below. If we are ever to get organized, we must take action and get involved. It starts today ... it starts with you.

To leave a comment about what you want to do, click on the word "comment" below. To email this article to a friend, click on the envelope icon below. If we are ever to get organized, we must take action and get involved. It starts today ... it starts with you.

IT'S YOUR GAS ... ENJOY IT!

Friday, March 14, 2008

Howdy Neighbor! ... Cont'd

Billy K. Lemons is a professional oil and gas consultant at Resource Analyt(SM) & Management Group. I appreciated that he took time to comment and clarify some issues on my previous post by the same title. As you will see he is very thorough and precise in his answer to my question. Question: Is it true that if a pipeline company has acquired an easement from a landowner, either by voluntary conveyance or involuntary conveyance (through condemnation), the pipeline company can place pipelines and other facilities, such as above-ground facilities, on the easement property without the consent of adjoining or neighboring landowners?

Question: Is it true that if a pipeline company has acquired an easement from a landowner, either by voluntary conveyance or involuntary conveyance (through condemnation), the pipeline company can place pipelines and other facilities, such as above-ground facilities, on the easement property without the consent of adjoining or neighboring landowners?

Answer: That may be a legal question that an attorney is more qualified to answer. But speaking as a landman in an educational way only, I’d say that the answer is generally, "Yes." Under typical circumstances, the pipeline company needs no approval of adjoining or neighboring landowners to exercise its rights acquired under the easement conveyance.

When a pipeline company acquires an easement on or across a piece of property, it acquires rights in that property, a portion of that bundle of rights referred to as real estate. It is free to exercise whatever legitimate rights it acquired under the conveyance, subject to: 1) the terms and conditions of the conveyance; 2) any superior rights owned by others in that same piece of property; 3) federal, state and local law; and perhaps 4) any restrictive covenants covering the property.

Under the typical “standard” right-of-way easement agreements that pipeline companies convince most surface owners to sign, the pipeline company has rights of ingress and egress across the entire property that is subject to the easement, and it has the right to exercise those rights at any time without any prior or contemporaneous notice to the surface owner. The recording of the easement conveyance in the official public records of the county where the land is located is notice enough. If you own the land upon which the easement is located, the company operating under such a standard easement can come and go in your backyard, or whatever, whenever it wants and not even show you the courtesy of first knocking on your door, much less your neighbor’s door.

Also under the typical standard pipeline easement agreement, the company has the right to install “surface facilities,” which can be any kind of above-ground system of pipes, values, gages, etc., without need for any further authorization from or notice to the owner of the property, much less the owner’s neighbors. But again, such things are subject to the terms and conditions of the easement conveyance, to federal, state and local law, and perhaps to any restrictive covenants covering the property.

So typically, if a pipeline company sticks some big, ugly gathering system facilities across the street from your house, you generally have nothing to say about it unless it’s in violation of law or is a bona fide nuisance of some sort.

The pipeline easement agreements we use with our clients in selling right-of-way and easement to pipeline companies are much more restrictive than the standard easement. Plus, we have two versions, one which excludes the right to install surface facilities (the version we use most), and another that includes rights to install specific, restricted surface facilities. In my view, one should never sign any standard or other easement presented to him by the pipeline company, unless for some reason he just has to. (Never believe the pipeline company when they tell you that you have to do this or do that. Always seek qualified outside counsel.) Neither should one ever accept the purchase price originally offered. It is always low-ball. Most any landowner gets burned badly who tries to represent himself in negotiations for pipeline rights-of-way and easements.

It seems to me that to protect yourself and your neighbors from unsightly pipeline facilities, your best bet it through better local ordinances. If the damage has already been done and the facilities are a bona fide nuisance of some sort, the courts may be your only recourse.

If a problem exists or is apparently forthcoming, the best advice I could give would be to take the matter up with your local real estate attorney. He or she can better advise you of your options.

Billy K. Lemons

Principal Consultant

Resource Analyt & Management Group

P. O. Box 632507

Nacogdoches, Texas 75963

BKLemons@ResourceAnalyt.com

936-569-7228 Office

936-569-7220 Facsimile

ResourceAnalyt.com

IT'S YOUR GAS ... ENJOY IT!

Chesapeake "Helps" Us?

I found another reference on the cost of production and value of production in the Barnett Shale. Last October, Chesapeake announced first D/FW Airport natural gas production and total production estimates that substantiate my recent analysis. According to the Dallas Business Journal (http://dallas.bizjournals.com/dallas/stories/2007/10/29/daily15.html, Chesapeake expects 2.5 to 3 billion cubic feet of production per well. At $10 per cubic foot, that substantiates my estimates. Each well will produce $25 to $30 million. If prices do not rise above the current $7 per 1000 cubic feet, these wells will still produce over $17 to $21 million each.

According to the Dallas Business Journal (http://dallas.bizjournals.com/dallas/stories/2007/10/29/daily15.html, Chesapeake expects 2.5 to 3 billion cubic feet of production per well. At $10 per cubic foot, that substantiates my estimates. Each well will produce $25 to $30 million. If prices do not rise above the current $7 per 1000 cubic feet, these wells will still produce over $17 to $21 million each.

Further the article wrote that the cost of production will be only $2 per 1,000 cubic feet or $5 to 6 million per well. It is not clear if this cost includes royalties or other post-production or overhead costs. However, I tend to think that it does not include royalties but may include post production expenses.

In any case, if royalties add another $2 per 1000 cubic feet to the cost of production, Chesapeake will book a very healthy $7 to $20 million in profit per well after all their expenses. Note that this gas was "donated" to Chesapeake by the tax payers of Tarrant and Dallas County that set up and funded DFW Airport.

Did the Airport Board drive a hard bargain? You tell me.

Do Chesapeake and/or the Board even say thank you? No, Chesapeake just has land men combing the neighborhoods trying to sign up more leases and Airport Board continues to charge incredible prices for parking.

How could they say thanks? Perhaps they could at least build a few free parking spaces at DFW and set up a low-cost airport shuttle service. Perhaps they could make reduced-cost gas available to local utilities. If gas was sold to utilities at $4 per MCF, then everyone in Tarrant and Dallas county would benefit directly from the gas production at DFW.

But instead, Chesapeake has the audacity to continue to offer as little as 1/5th of signing bonus they paid at DFW; i.e., as little as $2,000 compared to the $10,000 per acre. Give me a break!

Is it just me, or do others feel like they have been and are being smashed in a massive rip off?

IT'S YOUR GAS ... ENJOY IT!

Tuesday, March 11, 2008

Misunderestimated ??

In my previous post, I estimated that the value of recoverable gas in the Barnett Shale area is over $1,000,000 per acre. However, that may be too low since it was based on an estimated 160 billion cubic feet of gas reserve per square mile and a 50% recovery of that reserve. Actual reserve values and recovery factors vary.

It is difficult to get data on the lifetime production of an average well and it's effective acerage but the correct value could be much greater than $1,000,000 per acre. The amount in the reserve depends not only on the size (acerage) of the property but on the thickness and condition of the shale deposit.

According to the Texas RRC, a number of the new wells in Tarrant County start out producing over 50,000,000 cu.ft. of gas per month. Current prices are about $7 per 1000 cu.ft. (MCF) so these wells are producing $350,000 per month.

But does anyone think the price of natural gas will NOT increase over the next 10 years? A better estimate of the average price is probably at least $10 per MCF. Some estimates that I have seen place total production from $10 million to $30 million per well.

Of course production depends on many factors. Underground faults can both cause leakage losses and make it difficult to fracture the shale properly. The skills and techniques of the driller and completion experts can also effect production and recovery factors.

However, the greatest factor determining production is the density of drilling and fracturing. If a well has an 2000 ft long horizontal or "lateral" section and if the fractures in the shale spread out 200 feet on either side of the lateral, the area addressed by that well is 2000 ft by 400 ft or 800,000 sq.ft.

Since an acre is 43,560 sq. ft., this 2000 ft lateral can recover gas from just under 20 acres. Thus we see that a single well can only tap the gas from a fairly small area. If only one well is drilled in a 160 acre pooled drilling unit, not much of the gas will be recovered. The density of wells is thus the most significant factor in producing gas from the Barnett Shale.

By drilling eight wells in a 160 acre drilling unit and using techniques like simultaneous fracturing, recovery can exceed 50% ... perhaps significantly. While this may be optimistic estimates, it would thus seem that a resonable estimate might be over $1.5 million per acre!

*********** $1,500,000.00 per acre ************

Note that when a property owner signs the typical lease, they are allocating 75% or more of their gas to the well operator. The owner only retains benefits from the 25% (or less) royalty.

Estimates of well cost range from $2 million to $5 million per well. If a single well costs less than $5 million and taps the gas in about 20 acres, the owners of land may be agreeing to pay the operator an average of $15 million for drilling that $5 million well ... a $10,000,000 per well profit! Even if the profit is only about $5,000,000 per well, is it any wonder operator representatives are being paid to go door to door and are offering almost $20,000 per acre in signing bonuses.

Hey ... I'm open to other information on the productivity of typical Barnett Shale wells. However, to date not a single expert in the oil and gas business has challenged my previous estimate. It's been several weeks since I published it and NOT ONE email or comment has been received to challenge this finding.

Perhaps no corrections were suggested because the experts know that the estimate was VERY conservative. Correcting the value would not be in the interest of the operators since owners would likely become more aggressive in pressing for higher royalties and bonuses if groups were aware of the profits margins.

I wonder what will happen now. Note that I have also heard (but not yet confirmed) that, based on recent drilling data, higher recovery factors may be possible with new techniques. Could $2 million per acre be more correct? Could $0.5 million or more per acre in royalties be possible? Probably not but who will step up to help owners understand the basic economic considerations of a gas lease? And is a 100% plus profit fair?

I am reluctant to sign anything till I know for sure that the deal is fair and drillers are being forthright in their dealings. What about you?

IT'S YOUR GAS ... ENJOY IT!

Haven't Signed Yet??

Know more about where you stand if you have not signed a lease yet. See this article on the Star Telegram Blog.

IT'S YOUR GAS ... ENJOY IT!

Thursday, March 6, 2008

Want To Know More?

There is a lot of information on the web about the ins and outs of the natural gas industry. In fact there is more information than many will want to explore. Links to some of the sites are provided here in the right hand column.

One good overview is provided by the Natural Gas Supply Association . One of links on this site provides a fairly detailed layman's description of the process from wellhead to burner. Be prepared to spend a while absorbing all the information.

Another resource on the Barnett Shale is provided by the Rail Road Commission of Texas. The RRC also has a maps on line that give you details of all permitted wells and pipelines in your area. These maps allow you to click on a well site or pipeline and see all the permits and related surveys as well as any well production data.

The Barnett Shale Energy Education Council is sponsored by several of the major Barnett Shale operators. It provides a good overview of the situation from the operator's point of view.

Another good overview is provided at Wikipedia's Barnett Shale entry.

These links and the ones in the right hand column of this site are some of the best online resources I have found and several of them have links to additional information. If you find a good one, leave a comment here and I will make sure it is posted.

IT'S YOUR GAS ... ENJOY IT!

Sunday, March 2, 2008

Howdy Neighbor!

What would happen to your property value if this were next door? They sound like a jet engine and can be heard for over a 1000 yards.

What would happen to your property value if this were next door? They sound like a jet engine and can be heard for over a 1000 yards.

When drilling is complete, wells supply gas to pipelines. Pipelines need to be at high pressure to move the gas cost effectively so compressors are required on the pipelines.

Nothing in the typical mineral lease specifies where these can be placed. In fact gas pipelines are treated like utilities in state law. They can place their capital equipment on property they control ... where it is needed without the consent of nearby surface estate owners.

It's like street repair. Work is done when scheduled without nearby owners consent. Even if it causes severe hardship or business failures, the public entities (utilities, cities, counties, states, etc.) that do the work do not have to get permission since their work is considered to be "in the public interest."

This compressor pictured above (owned by EOG) is in Mansfield. Property owners nearby are very upset but quite helpless.

Other compressors can be seen north of DFW Airport across Highway 121 from Bass Pro. Since drilling has only begun not many compressors have been installed ... yet. But the number will increase with time. How many are required and where they will be located is never discussed while operators and landmen are gathering lease commitments. Owners beware! You must be proactive with city and county government to get zoning and ordinances to control pipeline facilities. Far more common will be valving and well head "Christmas trees." There will eventually be about 30 of these per square mile. Of course they will likely be enclosed in fences and may have landscaping planted to hide them. But who will maintain the fence and landscaping?

Far more common will be valving and well head "Christmas trees." There will eventually be about 30 of these per square mile. Of course they will likely be enclosed in fences and may have landscaping planted to hide them. But who will maintain the fence and landscaping?

And what hazard does this equipment represent in an urban setting? What happens if it is struck by a high speed car full of teens? What happens to the neighborhood nearby if the well head is smashed by debris from a tornado? Is lightening a hazard?

In rural areas, current industry practice and state regulations are probably adequate. But in a city, such controls have not been well tested. Do insurance rates currently reflect such new risks?

I hate to be a worry wart but I know that I would look elsewhere if I were shopping for a new home and saw one of these installations next door to an open house. What would you do?

IT'S YOUR GAS ... ENJOY IT!

Friday, February 29, 2008

Could It Be We Look Stupid?

If you had a $250,000 house, would you lease it to me for 30 years for $200 per month rental payments? Note that I will also agree to pay all insurance and maintenance during the term of the lease. Well if you don't want to do that, how about selling me a 5 year option to that lease for $4000. Then you have a nice cash payment and I might not even exercise the option. And if I don't exercise the option, you can make another deal with someone else.

Well if you don't want to do that, how about selling me a 5 year option to that lease for $4000. Then you have a nice cash payment and I might not even exercise the option. And if I don't exercise the option, you can make another deal with someone else.

If the answer is "yes" to either offer, we need to talk. I have some swamp land that you would love.

But that (or much less) is what the operators are offering for a $250,000 mineral deposit under a typical 1/4th acre lot in Tarrant County (see my estimate). And owners are scrambling to take the deal. If that is what folks need and think is best for them to do, they are certainly encouraged to do so. But if not, why not explore other options?

Being a good steward takes effort. Email me at enjoygas@sbcglobal.net if you want to learn more and explore options before signing a lease. If a lot of folks work together, many options become viable.

IT'S YOUR GAS ... ENJOY IT!

Wednesday, February 27, 2008

What's That Funny Smell?

I woke up this morning to a glorious day. It was one of those famous North Texas winter days with the smell of spring in the air and a gentle breeze, lots of sun and highs in the 70's. Wow, why can't all winter days be like this? As I went to the mailbox, I noticed the neighbor's dog, a black Lab named Stinky, galloping around my yard looking for someone that wants to play. Of course when I bent over a little to rub his ears, he bolted away wanting me to chase him. I wasn't up to that but enjoyed watching his energy as I walked across the yard toward the mailbox.

As I went to the mailbox, I noticed the neighbor's dog, a black Lab named Stinky, galloping around my yard looking for someone that wants to play. Of course when I bent over a little to rub his ears, he bolted away wanting me to chase him. I wasn't up to that but enjoyed watching his energy as I walked across the yard toward the mailbox.

When I reached the box, I found a very official looking letter from Bale Estate Services. Hmmmm, "what's this?" I thought as I quickly opened the envelope. To my surprise, the letter said that a benefactor, Mr. B. Shale, had died and left me 1/2000th of his estate. It says that the total B. Shale estate was $500 million so my share will be $250,000.

Seems like I remember something like this on TV years ago. Yep, there was a show called "The Millionaire" where a guy would knock on a door and hand out checks for a $1,000,000. The rest of the show was spent observing what happened to the recipient after they received their windfall.

Wow, looks like I won the lottery and didn't even have to buy a ticket! How do I get my check?

Not so fast there Bugs Bunny. There is some fine print. Like the lottery, this is NOT a lump sum payment. Rather, the inheritance will be paid out over a period of 10 years and will be delayed a little.

Oh I see. Let me read the fine print. Payments will start two years from now at $56,000, then taper off 20% per year over the following 9 years until the whole $250,000 is paid.

Well that's not too bad. Where did I put that calculator? There it is ... OK, let's see. The payments will be $56k, $45k, $36k, etc. I guess I better not tell my spouse we are rich, but we can always use the extra cash. I'm sure we can spend it.

How about a new set of clubs and a big screen TV? We could use a better car and by the time the money gets here the kids will need their own car plus money for college. Could we afford one of those hot tubs, too? It was sure fun to dream as I walked back to the front door in a daze.

When I think about it, I believe that it is better that the money is paid out slowly. I won't have to pay as much income tax and I will have time to think and plan how to spend the money. Let's see, where do I sign to accept the offer? Wait a minute there Speedy. There are a few more details in the fine print. To get the the payments started, you and the other 2000 recipients have to ALL agree to make a sizable up front payment to Mr. Shale's favorite charity ... the Foundation for the Betterment of Rough Necks, FBRN.

Wait a minute there Speedy. There are a few more details in the fine print. To get the the payments started, you and the other 2000 recipients have to ALL agree to make a sizable up front payment to Mr. Shale's favorite charity ... the Foundation for the Betterment of Rough Necks, FBRN.

Oh yeah? How much do we have to give the FBRN?

Well it's not too much ... only $25,000.

TWENTY FIVE THOUSAND DOLLARS!!! How am I supposed to do that? No one has that much money sitting around. And how am I supposed to get the other 2000 recipients to sign up? That's impossible!

Calm down please. Mr. Shale knew it would be tough so he provided this option clause that makes it a lot easier. Mr. Shale arranged with Texpeake Services to help you out.

REALLY? What do you mean?

If you sign the option clause, Texpeake will take care of all the details and make sure the FBRN and all the other recipients get paid. Plus they will even pay you a nice "bonus" up front. Yep, they will pay you and all the other recipients $500 today and then pay 20% of Mr. Shale's payments as they arrive.

So let's see ... if I want, I can sign the option clause and Texpeake will pay me $500 now and $50k over the ten years that the on-going payments are made.

Yep, for their help, Texpeake will keep the other $200,000 of the payments to cover their donation to the FBRN and all the overhead that was required to keep track of the process. I know 80% seems like a lot to pay Texpeake for their management but it's a VERY complicated process and what other choice do you have? Here ... sign now and you get this nice $500 check.

WOW ... now I have a headache. Do I have any other choices? Neither one of these sounds like a "no brain-er." Plus I think I heard on the radio that some of the other recipients are getting a bigger bonus, up to $4000 and a little higher percentage, too.

Do I wait and hope for more than Texpeake is offering or take the sure $500 now? Why not just borrow the $25,000 for the FBRN and pay a little interest instead of having Texpeake handle everything? I could sure use the other $200,000 but would all the others join with me or will they just sign the Texpeake option?

I don't even know if this is real. Who is Mr. B. Shale anyway? Did he really have a $500 million estate?

Wow there sure are a lot of questions. I don't have time to figure this out. My head is spinning a little so, OK, let me review the bidding before I sign. If I sign the Texpeake offer, I get a check now for $500 then in two years I start getting a 20% share of the estate payments, about $11,000 the first year, right? No further delays or considerations, right?

Well, not exactly. Texpeake may not get it started quite that fast. They will give you the bonus check alright but it may take longer before you get the follow-on payments. Texpeake is very busy handling all the new estate payments and can't guarantee a payment of $11,000 in just 2 years.

Really, why is that?

Well first you will note that the total amount that must be paid to FBRN is 2000 times $25,000, about $50,000,000. That's more than Texpeake has available right now and besides the folks at FBRN can't spend more than about $2.5 million a year ... it's not a large group. Their charter only allows them to spend what they need each year. Their non-profit status with the IRS would be in jeopardy if they took too much at once. Thus it will take Texpeake and the FBRN about 20 years to make all those donations and therefore it will take a long time to get all those B. Shale estate payments underway.

But don't worry. The agreement with Texpeake allows them to pool all the recipients so everyone starts to get their proportionate share of the payments as soon as the first $5 million in payments to the FBRN are made and the two-year waiting period has passed. Your payments will be stretched out but you will still get the whole $50,000 you are due. It will just take 30 years instead of 10 years.

Now my head is REALLY spinning. I wish I had not gone to the mail box. This is just too bizarre for words! It just doesn't smell right.

And what IS that smell? Oh C%*P ... Stinky left a "present" in my yard. Now I have to go clean my shoe and those spots on the carpet too. Where did I put that bottle of aspirin?

IT'S YOUR GAS ... ENJOY IT!

Monday, February 25, 2008

How Many Wells and When?

To get 50% recovery of the 30 trillion cubic foot gas reserve in the Barnett Shale requires a lot of wells and a lot of fracturing. The Star Telegram in early December 2007 provided some guidance. In that article it was suggested that, to get 50% recovery of the reserve, a spacing of 20 acres per well is needed.

At that spacing, almost 30,000 wells would be needed in Tarrant County. That is a lot of "Christmas Trees", separators, well head valves and pipelines.

To put it in perspective, the RRC reported about 1500 completed wells in Tarrant County in 2007 plus there were about 1500 approved permits. Thus only about 10% of the wells required to produce the gas in Tarrant are completed or permitted.

Chesapeake, XTO, Carrizo and others are moving as fast as possible to tie up leases and drill enough wells to hold those leases, but the total number of rigs in Tarrant is only about 50. Each rig can drill about 12 to 15 wells per year so a total of about 700 wells can be drilled each year by all the current rigs. At this rate, to drill the required additional 25,000 plus wells will require about 40 years.

And what about getting pipelines to all those wells to gather production for sale. That many wells will require at least 1000 miles of new pipeline plus all the related separators, compressors, tank farms, etc.

Is it possible that equipment shortage is why no operators will commit to a specific royalty stream? Or could that be the reason they want 5-year leases that allow them to pool up to 640 acres? That lets them use a single well to tie up the minerals on a large block of land for 20 years while they drill more wells.

The operators tie up land and get a good return on investment but owners get strung along for years. Until wells are drilled in a tightly spaced pattern and fracturing is thorough, owner royalties will be meager. For example at 25%, one well that produces $20 million in gas on a 640 acre well pool will generate royalties of less than $8,000 per acre (under $800 per acre per year) while if wells are on a 20 acre spacing, royalties could be up to 32 times higher.

Of course as more wells are drilled in the large pools, more royalties will be generated. However, if it takes 40 or 50 years, the current owners will likely not benefit or care.

To encourage high royalties, leases need clauses that terminate the lease if production royalties are too low. But the typical leases let operators off the hook. Owners can rarely get control back and get another operator to execute the development in a timely manner. Operators do NOT want termination clauses and most owners don't know or think to demand them. If not demanded, guess what will happen.

IT'S YOUR GAS ... ENJOY IT!

What Happens At A Well Site?

Once a well is permitted, the drilling process begins. First the well site is prepared and the rig is brought in and made ready for drilling. Different rig manufacturers have somewhat different processes but one that is very efficient is shown on here .

Once a well is permitted, the drilling process begins. First the well site is prepared and the rig is brought in and made ready for drilling. Different rig manufacturers have somewhat different processes but one that is very efficient is shown on here .

After the rig is ready drilling begins. Here is an animation of what happens in the hole. The drilling process takes a week or two and is followed by casing the well and hydraulic fracturing. The drill bit is suspended from lengths of pipe. During the drilling process, the drill pipe has to be lowered and raised repeatedly. Here is a movie of the process of lowering and adding lengths (about 90 ft) of pipe with a highly automated set of rig tools.

The drill bit is suspended from lengths of pipe. During the drilling process, the drill pipe has to be lowered and raised repeatedly. Here is a movie of the process of lowering and adding lengths (about 90 ft) of pipe with a highly automated set of rig tools.

Once the well is drilled, the rig is torn down and moved to a new site (2 to 3 days) or skidded to the side about 20 ft (6 to 8 hrs) to a new well location as shown in this animation .

Sunday, February 24, 2008

Mineral Owners Lose In Court

There are several MUST read documents available at Texas A&M Real estate Center . These documents explain many issues to consider when leasing.

For example, surface owner rights are subordinate to mineral owners. Also surprisingly, even if the lease indicates royalties are to be paid without post-production expenses being deducted, that is not supported by case law. In fact, owners end up sharing in those expenses.

Here are some quotes from these documents.

1. One of the earliest and most significant cases decided by the Texas Supreme Court held that the mineral estate is dominant over the surface estate. The grant of the mineral lease gives the mineral lessee the implied right to use as much of the surface as is reasonably necessary for the exploration and development of the minerals. The surface owner’s consent is not required for this right to be exercised. The mineral lessee is liable for surface damages only in limited situations.

2. The shared expenses depend partly on where the lease fixes the royalty. Commonly, the royalty for oil is set "at the well" or "wellhead." In such cases, the mineral owner’s royalty payment is free of production costs, but all costs subsequent to production are shared. (Two 1996 Texas Supreme Court decisions, Heritage Resources, Inc. v. Nations Bank, 09-0515, and Judice v. Mewbourne Oil Co., 95-0115, so held even though the lease addendum stated the royalty was free of such costs.) If the lease fixes the royalty "in the pipeline," "at the place of sale" or at other delivery points, different costs subsequent to production may be shared. These costs may include items such as compression expenses necessary to make the product deliverable into the purchaser’s pipeline, expenses necessary to make the product salable, transportation costs and the expenses used in measuring production.

Until you sign the lease, you own both the surface and mineral estate in a single deed and have control over your estate. After signing, the mineral and surface estates are in separate deeds and will never be combined again. Plus you end up losing control of the surface estate too. I am not a lawyer and can not give legal advice but the old saying "BEWARE of strangers bearing gifts" seems to apply.

IT'S YOUR GAS ... ENJOY IT!

Saturday, February 23, 2008

Owners Explore for 75% Royalties

Could it be possible to generate the equivalent of 50% or even 75% royalties on the gross production of a well that includes your mineral acreage? I don't know but if the operators can generate 50% AFTER all development/completion/production costs and AFTER paying a 25% royalty to owners, it may be possible that, with appropriate support, a group of united owners might be able to increase their effective royalty from 25% while still getting the help they need to manage the drilling and production process.

I'd like to find out BEFORE I sign a lease that makes co-production impossible. Let me know what you think. Is it worth exploring? Leave a comment here.

IT'S YOUR GAS ... ENJOY IT!

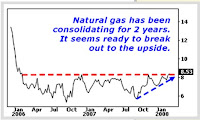

Gas Prices To Rise?

In a 2/13/2008 article at "Money and Markets" entitled "Natural Gas Looks Undervalued; Ways to Play It," Sean Brodrick believes that natural gas prices are unusually low compared to oil. If oil stays up, natural gas should also rise to maintain the historic ratio of oil to gas energy costs.

In a 2/13/2008 article at "Money and Markets" entitled "Natural Gas Looks Undervalued; Ways to Play It," Sean Brodrick believes that natural gas prices are unusually low compared to oil. If oil stays up, natural gas should also rise to maintain the historic ratio of oil to gas energy costs.

If so, this will make the future of the Barnett Shale even brighter and make cooperative or commercial development even more profitable. Could gas go up 50% or more? I hope so ... at least till I get my electric or gas bill.

IT'S YOUR GAS ... ENJOY IT!

What's it worth?

If you are like me and own a home in Tarrant County, you may have been surprised to get a big envelope in the mail offering to lease your minerals. Wow, someone wants to give me money! Maybe even thousands of dollars. And I don't have to do anything but open the mail and sign the draft lease that is enclosed. Mailbox money ... how wonderful!

Then the old warnings my momma told me, like "sounds too good to be true" or "beware of strangers bearing gifts," start coming to mind. What is this lease anyway? It takes 4 legal sized sheets of single spaced print that is almost too small to read to document the terms that accompany the offer. Why so complex?? If they want to give me money, just send it.

"Maybe there is more to consider," one thinks. So you start listening to the news, reading articles in the newspaper and searching the web for information on what a mineral lease is all about.

Then the questions really begin to multiply. Who really owns these minerals? One finds out that they may need a legal expert to advise them on "Pugh clauses," "post-production deductions" and "surface rights." What is a fair offer ... some are getting over $20,000 per acre ... others only $2,000 per acre? Terms vary from 3 years to 5 years. Some get credit for streets and alleys ... some do not. Some get 25% royalty ... others 3/16ths or less. And 25% of what and when will that start and/or end? What happens if I need to sell my home ... will new legal or closing costs pop up that wipe out all my profits? Will my property taxes rise? Do I have to put up with huge, dangerous, noisy, stinky, ugly stuff in my neighborhood that tears up roads and invites "rough necks" to look over my fence?

What are they really asking me to do? Will they tear up my streets? Will they permanently install big ugly equipment? When will the money arrive? How much now? How much later? Why are they going to all this trouble? Is it good for me, my family, my neighbors?

One feels a little overwhelmed and doesn't understand the implications but "what the heck" its quick "free" money. The letter is written nicely on fine bond paper with a great looking letterhead ... but its too complex to figure out. I don't have a better offer so maybe one should just sign, take the money and forget it. What will be, will be.

The meetings with operator representatives lead one to believe signing is urgent and you may loose this opportunity if you don't sign now. No one will ever offer more, they claim. It's so risky and complex to drill. They have all the tools and knowledge to get the permits, equipment and pay the royalties. "I'm lucky to get this deal ... just sign here," they urge.

But I guess they didn't count on me having the time to really look into the subject or knowing how to use the Internet to make my findings known. It's a new day and age and I'm a retired R&D engineer from Lockheed Martin. I actually may know how to explore and address some of the issues.

That is why I am writing this blog. I studied and I found some things that I hope others will be glad to know without doing all the work that I did. Things that can be quite difficult to find.

I hope you enjoy some of the highlights that follow but be forewarned, these are preliminary findings that I believe are true but are subject to change with additional discovery. Also note that while I believe these things to be true ... you should confirm them independently and do your own due diligence before signing any lease or committing to any investments.

FIRST: What are my minerals worth?

According to a Fort Worth Star-Telegram article in early December, just over half of the Barnett Shale gas reserve is recoverable if horizontal wells are drilled on a 20 acre spacing and successful hydraulic fracturing of the shale is done. If one assumes that the average price of gas over the next 20 years will be at least $10 per 1000 cubic feet, about $1,000,000 per acre is recoverable.

That explains it! No wonder the operators are clamoring to lease Tarrant County. $1,000,000 per acre! $250,000 per 1/4th acre lot! If it doesn't cost too much to drill, no wonder they are willing to pay thousands per acre to get the right to drill.

SECOND: What does it cost to drill?

Again this information is a little tough to find but there are a number of sources of estimates. The Department of Energy and web sites of the major drillers and tool companies offer some guidance.

For example, Baker Hughes has drill bits that they claim can drill over 100 feet per hour so the time required to drill to a depth of 8000 feet then add a 4000 foot lateral (horizontal) bore (12,000 ft total) should be about 120 hours (4 to 5 days). At 10% per year interest rates plus 100% overhead, the $30 million of equipment at a typical drill site should cost under $1000 per hour to lease. Consumables and labor should add less than another $1000 per hour. Thus initial actual drilling may be as low as $250,000. Even doubling that estimate comes to only about half a million for a typical well.

To this drilling cost, the cost of site planning, engineering, permitting and preparation must be added prior to drilling. Seismic data collection, instrumentation, laboratory analysis of samples and other related costs are significant and must be added to the drilling. Then after drilling, the cost of casing and cementing, fracturing and completing must be added along with site cleanup, pipeline connection and finalization. Of course to that one must add appropriate overhead, insurance and profit but it is hard to see how well costs could exceed $2,000,000 for a well that some estimate could produce $20,000,000 worth of gas.

It is not clear what they included to increase this estimate, but I have seen estimates from XTO, Chesapeake and others of as high as $5M per well. In any case, weather it is $2M or $5M, the drilling of a well in the Barnett shale is, on average, very profitable for an operator. From the operator's view, a well produces $20 to 30M but costs him at most $5M to drill and maintain plus about $4 or $5M in royalties to the property owners. That leaves a tidy amount, $10,000,000 per well net to the operator from which to pay more landman fees, signing bonuses, tax accountants, lobbyists, campaign contributions, country club dues, shareholder dividends, etc., etc.

On the other hand, from the mineral owners point of view, a typical 1/4th acre suburban lot may be able to produce about $250,000 in gas. From that production the owner will get a signing bonus of from $500 to $5000 up front plus (if fully developed to 20 acre well spacing) royalties totalling up to $50,000 over the 20 to 30 year life of a well unit. Production (and thus royalties) are higher at first (perhaps up to $10,000 per year) and taper off over the years to well below $1000 per year as the gas is sold.

When signing the lease, the owner is thus giving the operator (and any subsequent companies that may buy your lease from the original lessee) the exclusive control and right to develop and extract all minerals at all depths under the property. For that the owner gets an on-going share of the resulting production value (if any) and a one-time signing bonus.

Now you know ... in addition to the house and property you bought, YOU also probably own about $250,000 worth of gas in the subsurface mineral estate. That's a nice bonus but it comes with additioinal responsibility. It is your responsibility to manage your newfound mineral estate for the best interests of you and your family.

IT'S YOUR GAS ... ENJOY IT!